Table Of Content

- Mortgage rates for April 23, 2024: Rates trending about the same

- Traditionally, a mortgage down payment is at least 5% of a home's sale price.

- Affordability calculator

- Subscribe to Kiplinger’s Personal Finance

- Is a down payment required?

- Bankrate logo

- Places with the lowest median down payments (in dollars)

View the Chase Community Reinvestment Act Public File for the bank’s latest CRA rating and other CRA-related information. View today’s mortgage rates or calculate what you can afford with our mortgage calculator. A preapproval is based on a review of income and asset information you provide, your credit report and an automated underwriting system review. The issuance of a preapproval letter is not a loan commitment or a guarantee for loan approval. Preapprovals are not available on all products and may expire after 90 days. It can be beneficial to work with someone who knows the answers to all these questions.

Mortgage rates for April 23, 2024: Rates trending about the same

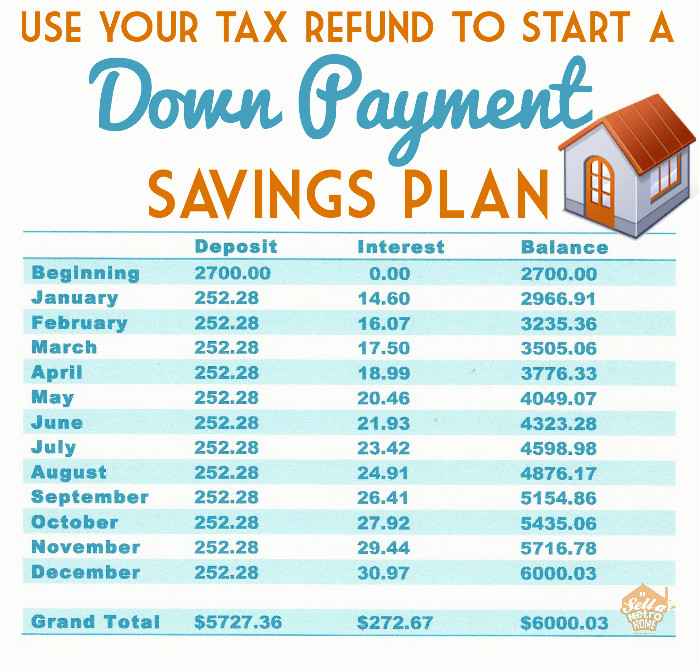

Here’s how this might look if you’re considering a $500,000 home with a 7% interest rate. Note that in this example, the difference between a 0% down payment and a 20% down payment is more than $1,000 per month or $12,000 annually. Whether it’s better to make a bigger or smaller down payment will depend on your financial circumstances and what you’re realistically able to afford. Open a dedicated savings account for your down payment, cut your spending, pay off high interest debt, and perhaps get a second job to supplement your savings plan.

Traditionally, a mortgage down payment is at least 5% of a home's sale price.

Buyers can withdraw from a 401(k), but may incur early 10% withdrawal penalties if the buyer is under 59. Plus, the beneficiary must pay income tax on the money taken out and consider that the added income can place them in a higher tax bracket. While some buyers in California may pursue down payment assistance programs if they qualify, others turn to family for help with their down payment and closing costs. Legal in 40 states, including California, commission rebates enable real estate brokers to provide a percentage of their commission back to new homeowners when they purchase a home. Not all brokers offer commission rebates, which is why buyers should ask about them when interviewing a potential buyer’s agent. Loan approval is subject to credit approval and program guidelines.

Affordability calculator

Indiana First-Time Home Buyer 2024 Programs and Grants - The Mortgage Reports

Indiana First-Time Home Buyer 2024 Programs and Grants.

Posted: Tue, 23 Apr 2024 07:00:00 GMT [source]

Most programs are designed for low- to middle-income borrowers who are buying a home for the first time. We believe everyone should be able to make financial decisions with confidence. According to NAR, approximately 7% of buyers received gift funds for home purchases in 2022. Buyers ages 24 to 32 make up 19% of those that are most likely to use a mortgage gift for purchase, and 12% are ages 33 to 42. For instance, the average median down payment was $34,248 in Q2 2023, down 3.3% year-over-year from $35,410. The median sales price decreased by 7.4% from $449,300 to $416,100 over a similar period.

Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. VA loans are funded by a lender and guaranteed by the Department of Veterans Affairs. The primary benefit of pursuing this type of loan is it may not require a down payment. Further, putting 20% down on your home when you purchase can help show the bank — and yourself — that you're financially ready to purchase a house.

Subscribe to Kiplinger’s Personal Finance

Average Down Payment For First-Time Homebuyers - Bankrate.com

Average Down Payment For First-Time Homebuyers.

Posted: Fri, 23 Feb 2024 08:00:00 GMT [source]

The average down payment for a second home or investment property is 27% of the purchase price, according to Realtor.com’s 2023 Down Payment Report. While this housing market sector isn’t as prevalent as primary residences, the higher amount signals that buyers with disposable income can put more money down. Lastly, let’s take a look at the average down payment for home buyers who choose to put 20% down. By investing this amount (or more) on a purchase, borrowers can avoid the extra cost of private mortgage insurance (PMI). That’s because PMI is usually required whenever the loan-to-value ratio rises above 80%.

In addition, borrowers risk losing their down payment if they can't make payments on a home and end up in foreclosure. As a result, down payments act as an incentive for borrowers to make their mortgage payments, which reduces the risk of default. But not all buyers want to lower their down payment, as providing more equity upfront reduces interest rates and chips away at the principal. Regardless of the type of loan, buyers should shop around when looking for mortgages. Generally, lenders allow buyers to use their retirement savings, but they must be alerted when applying for a mortgage as it can trigger additional costs.

The second ratio, 36% of your gross monthly income, is your debt-to-income ratio calculation. This value pays the total sum of your debts, including your mortgage. The size of your down payment depends on your savings, income, and budget for a new home. The amount you designate as a down payment helps a lender determine the loan amount for which you qualify and the type of mortgage that meets your needs. Paying too little upfront will cost you interest over time while putting down too much could deplete your savings or negatively affect your long-term financial health. A down payment shows lenders that you’re serious enough about home ownership to invest your own savings in the property.

Places with the lowest median down payments (in dollars)

Aspiring buyers typically ask, “Is it best to put 20% down on a house? ” This is a laudable goal as a minimum 20% down payment waives private mortgage insurance (PMI) on conventional loans. However, eligible borrowers can put down as little as 3% but pay additional fees.

Many borrowers put down more than the minimum, either through savings, gifts or down payment assistance. In step with the housing market, the typical down payment has changed over time based on home prices, mortgage rates and other factors. Looking back to 2005, the lowest median down payment between now and then was a mere $1,000 in the fourth quarter of 2006. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. Savings—Most home-buyers save up for their down payments by setting aside savings until they reach their desired target, whether it's 20% or 3.5%.

Kim Porter is a writer and editor who's been creating personal finance content since 2010. Kim loves to bake and exercise in her free time, and she plans to run a half marathon on each continent. Lenders will review your credit to see if you qualify as well as to determine your interest rate — so it’s a good idea to check your credit beforehand. You can use a site like AnnualCreditReport.com to review your credit reports for free. If you find any errors, dispute them with the appropriate credit bureau to potentially boost your credit score.

The second is based on the minimum percentage you need to put down. Housing prices — and down payments — vary widely depending on where you live. Let’s take a look at the data by state, according to Q data compiled by the research team at Realtor.com. Saving for a down payment can be overwhelming since it’s a considerable cost.

The only caveat is that the home-buyer is only given 120 days to spend the withdrawn funds, or else they are liable for paying the penalty. Spouses can each individually withdraw $10,000 from their respective IRAs in order to pay $20,000 towards their down payment. If the home price and down payment percentages are known, use the calculator below to calculate an estimate for an amount needed in cash available for upfront costs.

Of course, not all buyers will end up paying the statewide median price when buying a house. Those who live in the San Francisco Bay Area, for example, could end up paying a lot more than the $833,910 figure mentioned above. On the other end of the spectrum, home buyers in places like Fresno and San Bernardino could probably get by with a much smaller down payment. Making a large down payment reduces your monthly payment, especially if you can reach 20% down. This eliminates mortgage insurance, lowering your overall payment considerably. Maurie Backman is a personal finance writer covering topics ranging from Social Security to credit cards to mortgages.

The down payment for an ARM is typically between 3 and 20% and will require PMI for buyers who put down less than 20%. A bigger down payment can make it easier to get approved for a mortgage and allow you to buy more house for the same monthly payment, or even less. These funds are deposited into an escrow account managed by a real estate attorney or settlement officer. Once the deal is finalized, this third party distributes the funds to the seller, who ultimately receives the down payment.

Mortgage allows for a 3% down payment for borrowers at or above 80% of area median income requirements. Lenders require homebuyers to make a down payment for most mortgages. These are conventional loans with low down payments or grant assistance programs. DTI represents how much of your monthly income is used to pay off debt, and most mortgage lenders require a DTI around 43% or lower.

No comments:

Post a Comment